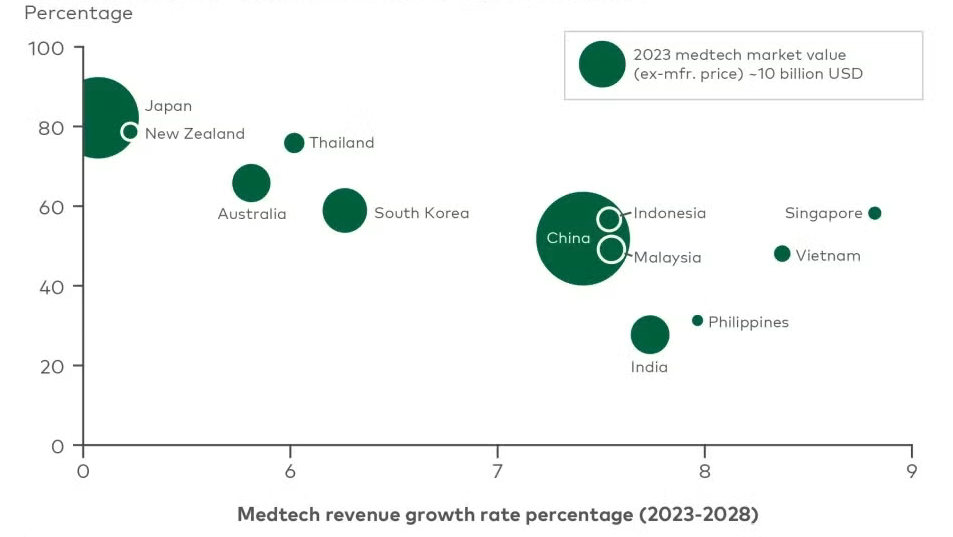

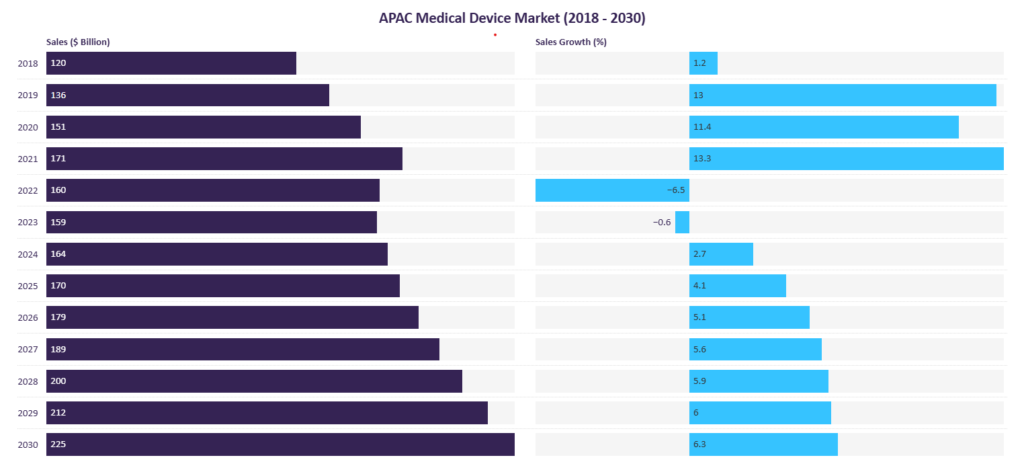

The medical device market in the Association of Southeast Asian Nations (ASEAN) represents one of the world’s most dynamic growth frontiers, propelled by strong macroeconomic fundamental, demographic shifts, and increasing healthcare expenditure. The broader Asia-Pacific market was valued at approximately USD 78.25 billion in 2024 and is on a trajectory to reach USD 147.77 billion by 2031. With this expansive region, Thailand has emerged as a pivotal market, branding itself as the medical hub of Asia. Thailand’s market reaches USD 2.23 billion in 2024, driven by a world-class tourism sector, a rapidly aging population, and robust government support through the Thailand 4.0 and Medical Hub initiatives. However, the market Is defined by a central paradox: while Thailand is ASEAN’s largest exporter of medical devices, its domestic manufacturing is concentrated in low-to-mid-technology consumables. Consequently, it remains heavily dependent on imports for the sophisticated, high-value equipment required to sustain its premium healthcare services.

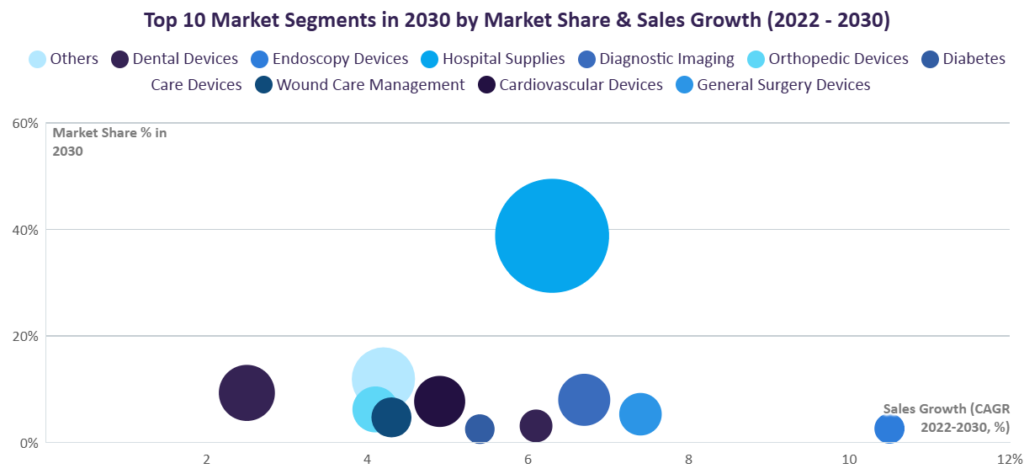

According to L.E.K. Consulting and GlobalData’s reports, Southeast Asia stands out as one of the most rapidly growing sub-markets. Healthcare spending across the major ASEAN countries is projected to increase by a significant 6% to 10% annually between 2022 and 2032, making it a focal point for global MedTech investment. The demand is particularly acute in specific segments. The ASEAN medical diagnostics market, for example, is on a remarkable growth trajectory, forecast to expand from an estimated USD 11.46 billion in 2024 to USD 18.42 billion by 2028.

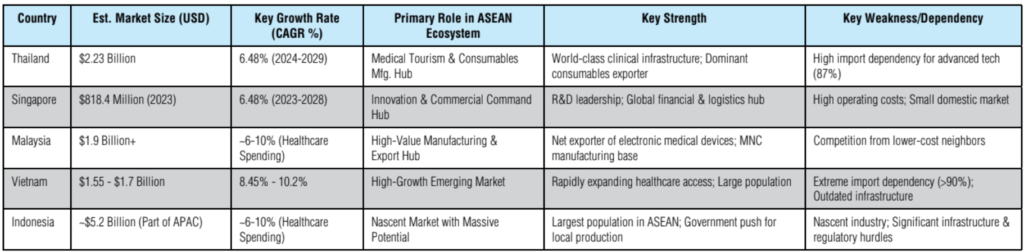

The ASEAN market is best understood not as a single entity but as a multi-tiered ecosystem where member states have developed specialized, often complementary, roles. This tiered structure has profound implications for corporate strategy, influencing decision on where to locate R&D, manufacturing, and commercial operations.

Tier 1: Innovation & Command Hub (Singapore). Singapore functions as the undisputed nerve center of the ASEAN MedTech industry. It is the regional premier hub for R&D, finance, and commercial headquarters, serving as a gateway for multinational corporations (MNCs) seeking access to Southeast Asia. It is home to R&C centers for over 30 global MedTech firms, including Becton Dickison, Alcon, and Hill-Rom. Its MedTech sector is a significant economic contributor, generating approximately SGC 19 billion (approximately USD 14 billion) in manufacturing output in 2022. Singapore is a net exporter of high-technology medical devices, strategically re-exporting around 70% of its imports, and leads to the region in per-capita healthcare expenditure, reflecting its advanced healthcare system.

Tier 2: Manufacturing and Export Powerhouse (Malaysia & Thailand). This tier consists of countries with strong manufacturing capabilities that serve as regional and global production centers. Malaysia: The country has successfully positioned itself as a hub for higher-value manufacturing. It is a net exporter of medical electronic devices, reporting a trade surplus of USD 747 million in 2023. This is driven by the production of sophisticated products like electro-diagnostic equipment, X-ray devices, and pacemakers, largely by MNCs such as Boston Scientific and Philips that leverage Malaysia’s favorable business environment for global export. Malaysia is also actively developing its medical tourism sector. Thailand: By value, Thailand is ASEAN’s largest exporter of medical devices and crucial manufacturing and distribution center for region. However, its manufacturing prowess is concentrated in lower-technology, high-volume single-use items like medical gloves, syringes, and catheters, which leverage its abundant supply of raw materials like rubber and plastic. The nation remains critically dependent on imports for nearly all its advanced medical technology.

Tier 3: High-Growth, High-Dependency Markets (Vietnam & Indonesia). These nations are characterized by their large population, rapidly growing economies, and nascent MedTech industries, creating enormous potential for growth. Vietnam: The Vietnamese market is projected to grow at blistering CAGR of between 8.45% and 8.62% through 2030. This growth is fueled by a government push to modernize a healthcare system where over 90% of medical equipment is currently imported and domestic production meets only 10% of total demand. This created a massive greenfield opportunity for foreign firms with solutions that can meet the country’s expanding healthcare needs. Indonesia: As the fourth most populous country in the world, Indonesia represent a colossal long-term strategic prize. Its medical device industry is still in its early stages and remains heavily reliant on imports for high-tech equipment like CT scanners and ventilators. While the government is actively promoting local manufacturing, as seen in the recent partnership between GE Healthcare and Kalbe Farma to establish a local CT scanner production facility, the technology and infrastructure gap remains vast.

In conclusion, by 2030, the competitive pressure from a technologically advancing Malaysia, an innovation-driven Singapore, and increasingly sophisticated and price-competitive Chinese manufacturing will only intensify. Thailand’s greatest strategic imperative is to leverage its one truly unique asset, its world-class clinical ecosystem, to climb the technology value chain. If it can successfully foster closer collaboration between its excellent hospitals and its nascent device industry to drive clinically informed innovation, it can secure a more resilient and prosperous future. If not, it risks remaining a highly lucrative but ultimately dependent market for foreign technology, a world-class user but not a creator of the next generation of medical innovations.

Article by: Asst. Prof. Suwan Juntiwasarakij, Ph.D., Senior Editor & MEGA Tech